UEN For Business in Singapore

A complete Guide For Business

All businesses and companies legally registered in Singapore are assigned a Unique Entity Number (UEN). This identifier serves as the cornerstone of business identification in Singapore. Understanding UEN requirements ensures seamless business operations and regulatory compliance.

This comprehensive guide explores everything you need to know about obtaining and managing your UEN in Singapore.

What is A UEN Number?

Understanding Singapore's Business Identification System

A Unique Entity Number (UEN) is a standard identification number issued to businesses when they incorporate a company in Singapore. It allows entities to interact with government agencies using a single reference number. As a result, administrative processes become more efficient and consistent.

In addition, the UEN replaces the need for multiple identification numbers. Instead of managing different references, businesses rely on one unified number. Therefore, communication with public agencies becomes clearer and less error-prone.

Moreover, the UEN is permanent and remains the same throughout the entity’s lifecycle. Even if a business changes its name, the UEN typically stays unchanged. Consequently, it provides long-term continuity for regulatory and administrative matters

Who Needs a UEN in Singapore?

Almost all registered entities in Singapore are assigned a UEN. This includes companies, partnerships, sole proprietorships, and non-profit organisations. As a result, most businesses will automatically receive a UEN upon registration.

In addition, foreign entities registered in Singapore may also be issued a UEN. For example, overseas companies with local operations often require one. Therefore, a UEN is not limited only to locally incorporated businesses.

However, individuals who are not conducting business activities do not need a UEN. Understanding this distinction helps avoid confusion when dealing with government agencies.

How Is a UEN Used by Businesses?

The UEN Singapore system is widely used across government platforms. For instance, businesses must use their UEN when filing taxes with IRAS or making CPF contributions for employees. As a result, the UEN becomes a core reference in daily operations.

Furthermore, companies need their UEN when applying for licences, grants, or government schemes. In many cases, applications cannot proceed without it. Therefore, keeping your UEN details accurate is essential.

Additionally, the UEN is often required for banking, invoicing, and contractual documentation. Consequently, it plays a critical role beyond regulatory compliance alone.

How Is a UEN Issued?

In most cases, a UEN is issued automatically when a business registers with ACRA. This means there is no separate application process for most entities. As a result, businesses can start using their UEN immediately after incorporation.

However, some entities receive their UEN from other issuing authorities. For example, societies and non-profit organisations may be registered under different government bodies. Therefore, the UEN format may vary depending on the entity type.

Even so, all UENs serve the same purpose. Regardless of format, they function as a single point of reference across government systems.

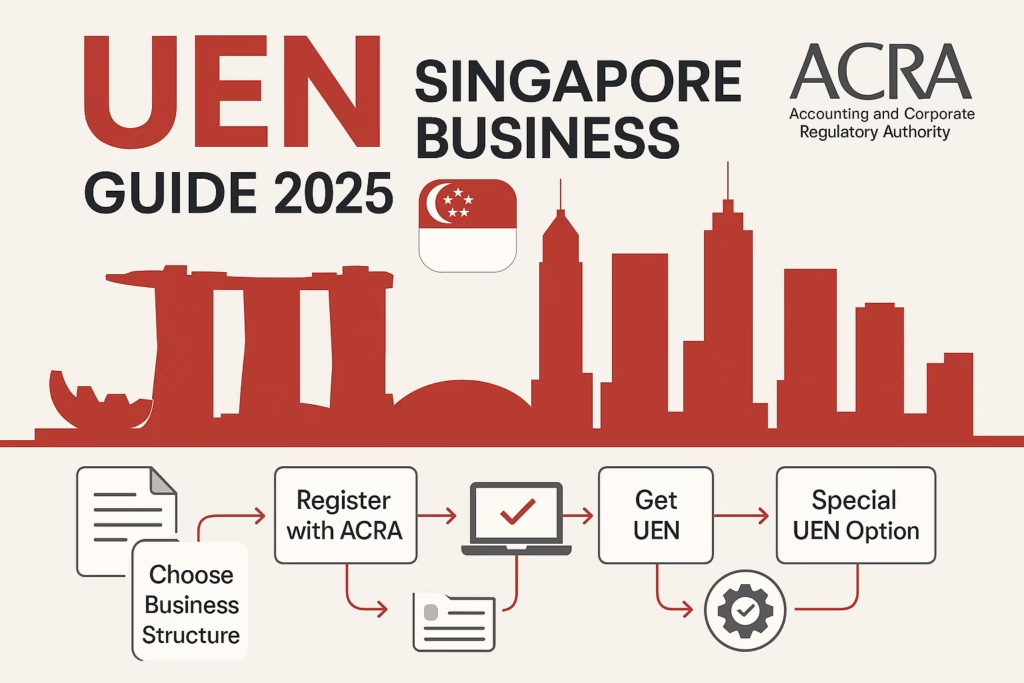

Step-by-Step UEN Registration Process

Obtain your Unique Entity Number (UEN) by completing business registration via ACRA’s BizFile+. This typically happens when you incorporate a company in Singapore . Here’s the streamlined flow.

Choose a business structure

Select the entity type that best fits your objectives and compliance profile. Making the right choice early helps simplify ongoing accounting and tax compliance .

- Private Limited (Pte. Ltd.)

- Sole Proprietorship

- Partnership / Limited Liability Partnership (LLP)

Prepare and submit documents

Gather identity verification, address proofs, and business activity details. If your business plans to hire foreign professionals , accurate information at this stage is especially important.

- Reserve a compliant name and prepare the Constitution.

- Submit your application through BizFile+ using SingPass authentication.

Payment & processing → UEN issued

Pay the government fee in BizFile+. Straightforward applications typically process within one business day. Once issued, your UEN will be required for work pass and S Pass applications .

- Fees vary by entity type.

- Upon approval, ACRA generates your UEN and updates the registry immediately.

Special UEN (SUN): What Is It?

A Special UEN (SUN) allows businesses to select a preferred number from ACRA’s reserved list instead of accepting an automatically assigned one. This premium option appeals to companies seeking a memorable, meaningful, or more professional-looking identifier.

Why Choose a Special UEN?

- Improved brand recognition and recall

- Ability to choose numbers with cultural or personal significance

- More polished and professional business communication

SUN Categories and Pricing

- Standard Special UENs: Moderately priced reserved selections

- Premium Special UENs: Higher-priced, popular combinations

- Lucky Number UENs: Premium pricing for auspicious or symbolic numbers

How Would I Apply for a Special UEN (SUN)?

SUN Application Timeline and Process

Apply for Special UENs during the business registration process or immediately after standard UEN assignment. However, changing from standard to Special UEN requires additional administrative procedures.

During Initial Registration

Select “Apply for Special UEN” option within the BizFile+ registration workflow. Browse available numbers from ACRA’s current inventory and choose your preferred option. Complete payment for both registration fees and SUN charges simultaneously.

Post-Registration SUN Application

Contact ACRA directly through their official channels to initiate SUN conversion requests. Submit required documentation including current UEN details and preferred number selection. Processing may take longer than initial applications due to administrative requirements.

SUN Selection Criteria

Consider these factors when choosing Special UENs:

- Number memorability for stakeholders

- Cultural or personal significance

- Brand alignment and marketing potential

- Long-term business implications

Remember that UEN changes remain permanent throughout your entity’s lifecycle, making initial selection crucial.

Regulatory Compliance and Documentation

Your UEN must appear on all official business documents, especially after you incorporate a company in Singapore, including:

- Invoices and billing statements

- Business correspondence and letterheads

- Government filing submissions

- Banking and financial documents

- Employment pass applications

- GST registration materials

Failure to display the UEN correctly may result in compliance issues. Therefore, businesses should maintain consistent records as part of their ongoing accounting and tax compliance .

Banking and Financial Services

Financial institutions require UEN verification for:

- Corporate bank account opening

- Business loan applications

- Payment gateway registrations

- Insurance policy arrangements

- Investment account setup

Because of this, accurate UEN details are essential when setting up business banking after company registration in Singapore.

Government Interactions and Licensing

UEN facilitates seamless interactions with government agencies such as ACRA, IRAS, and MOM for:

- Business licence applications

- Tax filing and statutory submissions

- Hiring foreign employees in Singapore

- Business permit renewals

- Regulatory reporting requirements

As a result, the UEN simplifies administrative processes while ensuring accurate entity identification.

Digital Payment Systems Integration

Modern payment systems such as PayNow Business require UEN registration for:

- Digital payment acceptance

- Fund transfer capabilities

- E-commerce platform integration

- Customer payment processing

Consequently, the UEN becomes integral to digital business operations, especially for companies operating in Singapore’s cashless economy.

Ongoing Responsibilities

Businesses must maintain accurate UEN records throughout their operational lifecycle. Update entity information promptly when changes occur to business structure, address, or activities.

Verification and Monitoring

Regular UEN verification through ACRA’s business profile services ensures data accuracy. Monitor your entity’s public records to identify any discrepancies requiring correction.

Common UEN Problems and FAQs

Can I change my Unique Entity Number (UEN)?

No, a standard UEN cannot be changed once it has been issued. However, eligible entities may apply for a Special UEN if a customised identifier is required. Therefore, businesses should confirm their details carefully during registration.

What should I do if my UEN details are incorrect?

If your UEN details are incorrect, you should submit an update through the relevant issuing authority. For example, ACRA-registered entities can make amendments via BizFile+. As a result, timely updates help avoid delays in filings or applications.

Do branch offices or subsidiaries have separate UENs?

In most cases, branch offices operate under the parent company’s UEN. However, separately incorporated subsidiaries are issued their own UEN. Therefore, the business structure determines how UENs are assigned.

Is a UEN required to open a corporate bank account?

Yes, most banks require a valid UEN when opening a corporate bank account in Singapore. In addition, banks may request incorporation documents for verification. Consequently, having your UEN available speeds up the onboarding process.

Does a UEN expire or require renewal?

No, a UEN does not expire and does not require renewal. Instead, it remains valid throughout the life of the entity. Nevertheless, businesses must keep related records accurate and up to date.

Important Notice: This guide explains the purpose and function of the UEN. While obtaining a UEN is automatic upon incorporation, the subsequent steps (like GST registration) have specific criteria. Please consult with us to ensure all your post-incorporation registrations are handled correctly.

Explore Our Essential Business Guides

- Singapore Incorporation: Step-by-Step Guide

- How to Register a Company in Singapore

- How to Select Your Ideal Company Name

- Why Choose Singapore for Your Business?

- Singapore Company Types & Structures Explained

- Post-Incorporation Compliance & Annual Filings

- Foreign Business Registration Options in Singapore

- Why Choose Malaysia for Business Incorporation

- Malaysia Company Types & Structures

- How to Register a Company in Malaysia