Company Incorporation in Singapore (2026 Update)

Singapore consistently ranks as one of the world's easiest places to do business — and in 2026, that momentum is accelerating. In December 2025 alone, 6,233 new businesses were registered, a 43.5% year-on-year increase, reflecting growing global confidence in Singapore as a headquarters and investment hub. According to our 2026 Singapore incorporation trends report, the surge is driven by geopolitical safe-haven demand, ASEAN market access, and one of the world's most competitive tax systems. This guide covers everything you need to know to incorporate your company in Singapore in 2026 — from choosing the right structure to staying compliant after day one.

Whether you are a first-time entrepreneur, a foreign investor expanding into Asia, or a business owner setting up a regional headquarters, this guide is for you. All company registrations in Singapore are administered by the Accounting and Corporate Regulatory Authority (ACRA) — Singapore's statutory regulator for business entities. For a deep dive into how ACRA works and what it requires, see our ACRA Singapore Essential Guide 2026.

Key Takeaways: Company Incorporation in Singapore

| Feature | Details |

|---|---|

| Foreign Ownership | 100% foreign ownership is permitted — no local partner required. See full foreign ownership rules → |

| Minimum Requirements | 1 resident director, 1 shareholder, 1 company secretary (within 6 months), S$1 paid-up capital, registered local address. |

| Most Popular Entity | Private Limited Company (Pte Ltd) — limited liability, separate legal entity, eligible for start-up tax exemptions. |

| Timeline | 1–3 business days via ACRA's BizFile+ portal once all documents are in order. |

| Government Fees | S$15 (name reservation) + S$300 (company registration) = S$315 total. See full cost breakdown → |

| Post-Incorporation | Annual returns, corporate tax filings, and AGM obligations are mandatory. View 2026 compliance checklist → |

Why Incorporate in Singapore in 2026?

Singapore remains the world's top-ranked destination for company incorporation in 2026, driven by political stability, a territorial tax system, and unmatched access to ASEAN's 680-million-strong consumer market. According to our State of Singapore Company Incorporation 2026 Report, December 2025 alone recorded 6,233 new business registrations — a 43.5% year-on-year increase — signalling a historic high in foreign investor confidence.

- 100% Foreign Ownership: Unlike most Asian jurisdictions, foreigners can own 100% of a Singapore company with no local partner requirement.

- Flat 17% Corporate Tax Rate: With a generous start-up tax exemption scheme, new companies can achieve effective tax rates as low as 4.25% in their first year of operation.

- No Capital Gains Tax: Singapore does not tax capital gains, making it ideal for holding companies and investment vehicles.

- Rule of Law and IP Protection: Singapore consistently ranks among the top globally for legal transparency, contract enforcement, and intellectual property protection.

- Pro-Business Government: Singapore Budget 2026 introduced a 40% corporate income tax rebate for qualifying companies, reinforcing the government's commitment to business growth.

- Strategic ASEAN Gateway: Singapore holds free trade agreements with over 27 partners and is home to more than 4,000 multinational regional headquarters.

- Speed of Incorporation: Company registration can be completed in as little as one business day through ACRA's digital BizFile+ portal.

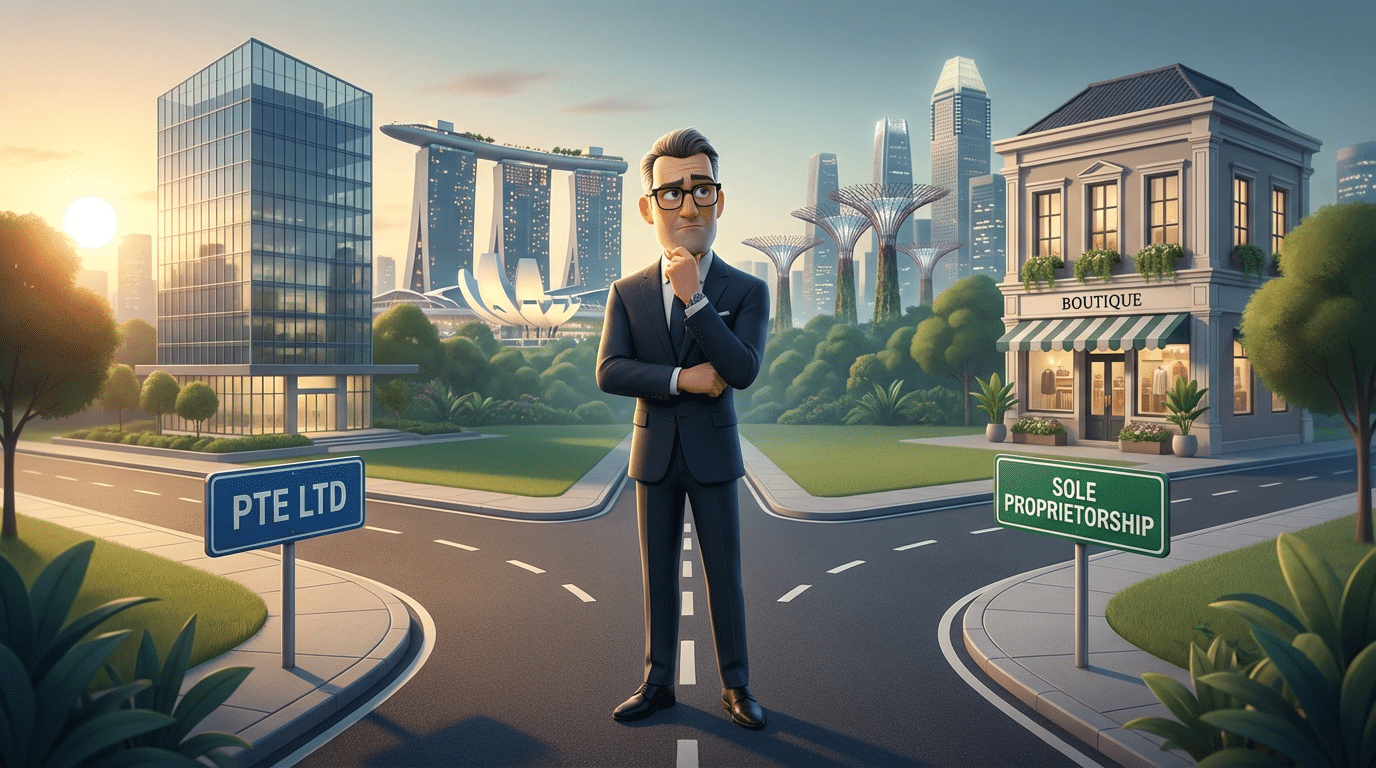

Choosing the Right Business Structure in Singapore

The right business structure depends on your ownership model, liability preferences, and long-term growth plans. For most entrepreneurs and foreign investors, the Private Limited Company (Pte Ltd) is the optimal choice — it offers limited liability, separate legal entity status, and the full range of Singapore's tax benefits. For a detailed breakdown of which structure suits your specific business model, refer to our Singapore incorporation guide 2026.

| Entity Type | Liability | Best For | Key Features |

|---|---|---|---|

| Private Limited Company (Pte Ltd) | Limited | Startups, SMEs, foreign investors | Separate legal entity, perpetual succession, 100% foreign ownership permitted, eligible for start-up tax exemptions. Recommended for most entrepreneurs. |

| Sole Proprietorship | Unlimited (personal) | Solo entrepreneurs, freelancers | Simple and low-cost to set up. Owner is personally liable for all business debts. Not suitable for foreign individuals. |

| Limited Liability Partnership (LLP) | Limited | Professional services firms (lawyers, accountants) | Combines partnership flexibility with limited liability protection. Partners are protected from each other's misconduct. |

| Subsidiary Company | Limited | Foreign MNCs seeking a permanent Singapore presence | A Singapore-incorporated Pte Ltd owned by a foreign parent. Legally separate — parent liability is limited to its shareholding. |

| Branch Office | Unlimited (parent fully liable) | Foreign companies testing the market short-term | An extension of the foreign parent — not a separate legal entity. Parent bears full liability. Cannot retain profits in Singapore. |

For most entrepreneurs — especially foreign investors — the Private Limited Company (Pte Ltd) offers the best balance of flexibility, credibility, liability protection, and tax efficiency. Our Singapore incorporation services cover all entity types from initial setup through ongoing compliance.

Minimum Requirements to Incorporate a Company in Singapore

To incorporate a Private Limited Company in Singapore, you must meet five statutory requirements under the Singapore Companies Act, administered by ACRA. All five must be in place at the time of registration and maintained throughout the company's life.

1. At Least One Resident Director

Every Singapore company must have at least one director who is ordinarily resident in Singapore — a Singapore Citizen, Permanent Resident, Employment Pass holder, or EntrePass holder. If you are a foreign entrepreneur not yet based in Singapore, you can engage a professional nominee director service to fulfil this requirement while you retain full operational control and sole bank signatory rights.

2. At Least One Shareholder

A minimum of one shareholder is required, either an individual or a corporate entity. Singapore imposes no restrictions on foreign ownership — foreigners can own 100% of a Singapore company with no requirement for a local partner or equity participation.

3. A Company Secretary

A qualified company secretary must be appointed within six months of incorporation. This mandatory role under the Companies Act is responsible for statutory filings, maintaining registers, preparing board resolutions, and ensuring ongoing compliance. Our corporate secretarial services cover this requirement as part of our incorporation packages.

4. A Registered Local Address

Every Singapore company must maintain a physical registered office address in Singapore. P.O. Boxes are not permitted. The address must be operational and accessible during business hours. Most foreign entrepreneurs use a registered address provided by their corporate secretarial firm.

5. Paid-Up Capital of at Least S$1

The minimum paid-up capital to incorporate in Singapore is just S$1, making it one of the most accessible jurisdictions in the world. However, if you plan to apply for an Employment Pass or open a traditional bank account, a higher paid-up capital — typically S$10,000 or more — demonstrates business credibility and improves approval outcomes.

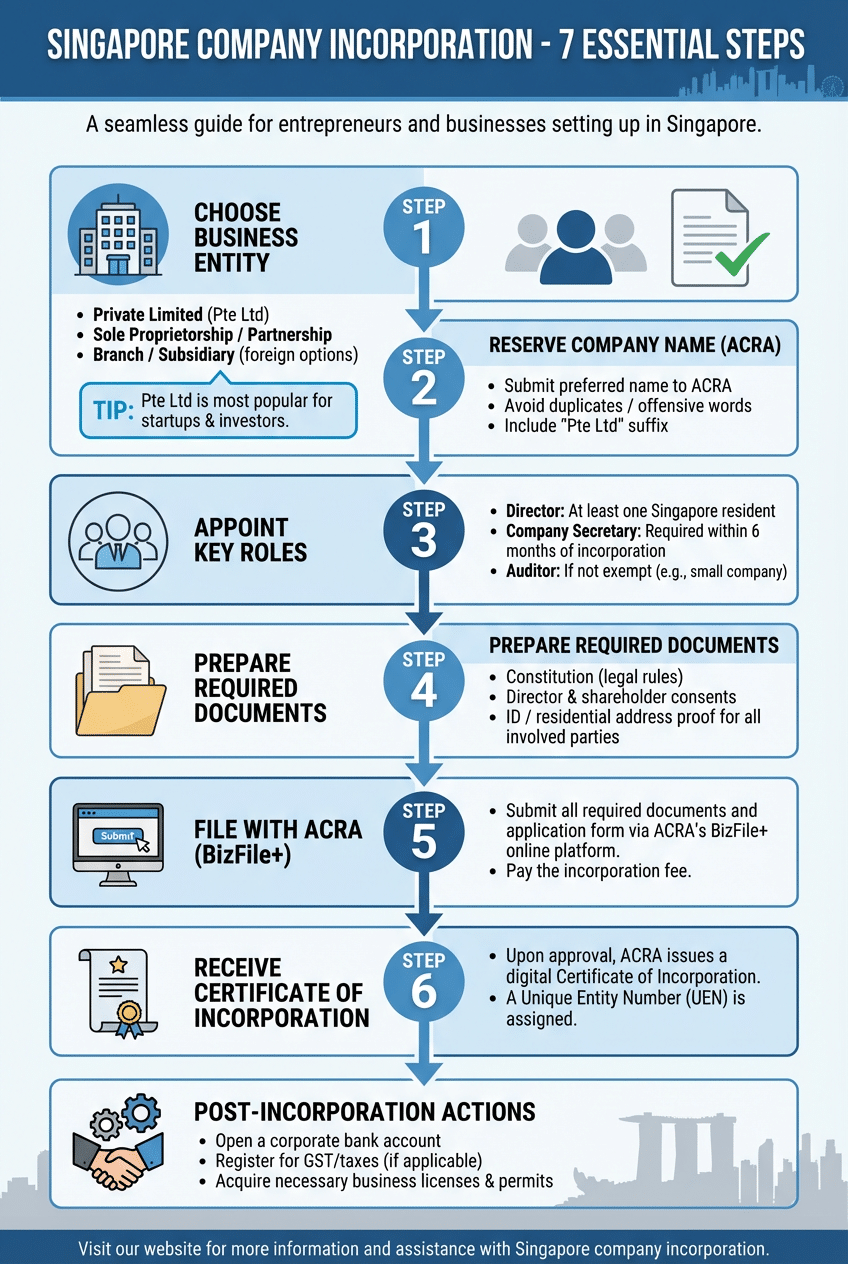

How to Incorporate a Company in Singapore: Step-by-Step (2026)

Incorporating a company in Singapore takes between one and three business days when all documents are in order. The entire process is handled digitally through ACRA's BizFile+ portal. Note that foreign individuals cannot file directly with ACRA — you must use an ACRA Registered Filing Agent (RFA) such as Terra Advisory Services to submit the application on your behalf.

Step 1 — Choose and Reserve Your Company Name

Submit your proposed company name for approval via ACRA's BizFile+ portal. The name must be unique, not identical or similar to existing entities, and must not include restricted or regulated words. The name reservation fee is S$15, and approval is typically instant or within one business day. Once approved, the name is reserved for 120 days.

Step 2 — Prepare Your Incorporation Documents

Once your name is approved, gather the following:

- Passport copies and proof of residential address for all directors and shareholders

- Company Constitution (ACRA's standard template is available and widely used)

- Registered Singapore office address details

- SSIC business activity codes (primary and secondary)

- Details of your company secretary arrangement

- Nominee director service agreement (if applicable)

Step 3 — Submit Your Application via ACRA BizFile+

Your ACRA Registered Filing Agent submits the complete incorporation application through BizFile+ on your behalf, ensuring all documents meet ACRA's requirements before filing. Terra Advisory Services manages this process end-to-end. For a full understanding of ACRA's role, fees, and processes, see our ACRA Singapore Essential Guide 2026.

Step 4 — Receive Your Certificate of Incorporation and UEN

Upon ACRA approval — typically within one hour to one business day of submission — you receive your digital Certificate of Incorporation and your Unique Entity Number (UEN). Your company is now a legal entity in Singapore. The ACRA registration fee is S$300, bringing total government fees to S$315.

Step 5 — Complete Post-Incorporation Setup

After incorporation, you must appoint your company secretary (within 6 months), open a corporate bank account, establish your accounting records, and prepare for your first-year compliance obligations. For a detailed post-incorporation checklist, see our Singapore company incorporation guide 2026.

Singapore Company Incorporation Costs (2026)

The total government fee to incorporate a Singapore company is S$315 — S$15 for name reservation and S$300 for registration. Professional service fees vary depending on your structure, ownership model, and whether you require additional services such as a nominee director or registered address. The table below reflects typical 2026 market rates.

| Item | Estimated Cost (SGD) | Notes |

|---|---|---|

| ACRA Name Reservation | S$15 | Government fee — non-refundable |

| ACRA Company Registration | S$300 | Government fee — payable to ACRA |

| Professional Filing & Incorporation Fee | S$500 – S$1,500 | Paid to your ACRA Registered Filing Agent |

| Nominee Director (if required, annual) | S$1,500 – S$4,000 | Required for foreign entrepreneurs without Singapore residency |

| Corporate Secretary & Registered Address (annual) | S$500 – S$1,200 | Mandatory — must be appointed within 6 months |

| Accounting & Tax Filing (annual) | S$800 – S$2,500 | Varies by transaction volume and company size |

| Estimated Total — First Year (without nominee) | S$1,815 – S$5,515 | Inclusive of government fees, secretary, and accounting |

| Estimated Total — First Year (with nominee director) | S$3,315 – S$9,515 | Typical range for fully foreign-owned companies |

Important: Budget not only for initial incorporation but also for ongoing annual compliance costs. Missing filing deadlines with ACRA or IRAS results in financial penalties. For a full year-on-year breakdown, see our Singapore corporate compliance 2026 guide.

The Resident Director Requirement: What Foreign Entrepreneurs Need to Know

Every Singapore company must have at least one director who is ordinarily resident in Singapore. This is the single most common challenge for foreign entrepreneurs — and it is easily resolved through a professional nominee director arrangement.

Who Qualifies as a Resident Director?

- Singapore Citizen

- Singapore Permanent Resident (PR)

- Employment Pass (EP) holder — minimum qualifying salary of S$5,600/month in 2026 (S$6,200 for financial services)

- EntrePass holder

- Dependant's Pass holder with a valid Letter of Consent (LoC)

What is a Nominee Director?

A Singapore nominee director is a Singapore resident who serves as your company's statutory director on ACRA records, fulfilling the legal requirement while you retain full operational control, 100% ownership, and sole bank signatory rights. The nominee handles compliance matters only — they do not manage your business, access your bank accounts, or make commercial decisions.

The Three Essential Protective Documents

A properly structured nominee arrangement must always include:

- Power of Attorney / Service Agreement — Restricts the nominee's authority strictly to compliance matters.

- Undated Letter of Resignation — Allows you to remove the nominee at any time without their cooperation.

- Deed of Indemnity — Protects the nominee from liability arising from your business decisions and confirms you bear full commercial responsibility.

2026 Nominee Director Fees

Professional nominee director services range from S$1,500 to S$4,000 per year depending on provider reputation, insurance coverage, and included services. Avoid freelance individuals offering nominee services without proper documentation — the cost saving is not worth the risk.

When Can You Stop Using a Nominee Director?

Most foreign entrepreneurs use a nominee director as a temporary bridge until they relocate to Singapore. Once you obtain a valid Employment Pass or Singapore Permanent Residence, you can serve as your own resident director and remove the nominee from ACRA records. For a complete breakdown of costs, risks, and how to protect yourself, read our full Singapore nominee director guide.

Post-Incorporation Compliance Obligations in Singapore (2026)

Incorporation is only the beginning. All Singapore companies must meet ongoing statutory obligations with both ACRA and IRAS (Inland Revenue Authority of Singapore) to remain in good standing. Failure to comply results in financial penalties, enforcement action, and in serious cases, company strike-off.

Annual Return Filing (ACRA)

Every Singapore company must file its Annual Return (AR) with ACRA. For non-listed companies, this must be done within 7 months after the financial year-end. The Annual Return confirms your company's key details — directors, shareholders, share capital, and registered address — are accurate and up to date.

Corporate Tax Filing (IRAS)

Companies must file their Estimated Chargeable Income (ECI) with IRAS within three months of the financial year-end, and submit the annual Corporate Tax Return (Form C-S or Form C) by 30 November each year. Small companies with annual revenue below S$5 million may qualify to file the simplified Form C-S (Lite).

Annual General Meeting (AGM)

Most private companies must hold an AGM within six months of the financial year-end. Certain exempt private companies may qualify to dispense with the AGM requirement if all shareholders pass a resolution to do so.

Corporate Secretarial Obligations

Your company secretary is responsible for maintaining statutory registers, preparing board and shareholder resolutions, and ensuring timely filings. Engaging professional corporate secretarial services ensures your company remains compliant as Singapore's regulatory environment evolves.

2026 Regulatory Update: Corporate and Accounting Laws (Amendment) Bill

The Corporate and Accounting Laws (Amendment) Bill, effective April 2026, introduces some of the most significant compliance changes in decades. Key impacts include stricter anti-money laundering (AML) requirements, enhanced shareholder protection rules, mandatory disclosure of nominee arrangements, and increased personal liability for directors. For a full breakdown of what is changing and what you need to do, see our Singapore corporate compliance 2026 guide.

Corporate Tax Benefits for Singapore Companies in 2026

Singapore's corporate tax system is one of the most competitive in the world. The headline rate of 17% is already among the lowest in Asia — but the real advantage for new companies lies in the generous exemption schemes available during the critical early years.

Start-Up Tax Exemption Scheme (First 3 Years)

Newly incorporated Singapore companies that qualify enjoy the following exemptions on their chargeable income for their first three consecutive years of assessment:

- 75% tax exemption on the first S$100,000 of normal chargeable income

- 50% tax exemption on the next S$100,000 of normal chargeable income

- Effective tax rate on the first S$100,000 of profit can be as low as 4.25%

Partial Tax Exemption (Year 4 Onwards)

- 75% tax exemption on the first S$10,000 of chargeable income

- 50% tax exemption on the next S$190,000 of chargeable income

Additional Tax Advantages

- No Capital Gains Tax: Singapore does not tax capital gains — highly advantageous for holding companies, asset disposals, and investment exits.

- Tax-Free Dividends: Under Singapore's single-tier dividend system, dividends paid to shareholders are fully exempt from withholding tax — shareholders receive dividends in full.

- Territorial Tax System: Foreign-sourced income may be exempt from Singapore tax, subject to economic substance conditions.

- Extensive DTA Network: Singapore has Double Tax Agreements with over 90 countries, reducing withholding tax on cross-border payments.

- Singapore Budget 2026 Rebate: Qualifying companies receive a 40% corporate income tax rebate (capped at S$40,000) under Budget 2026 measures.

Opening a Corporate Bank Account in Singapore

After incorporation, your company will need a corporate bank account to operate. Singapore offers a wide range of banking options — from established local institutions such as DBS, UOB, and OCBC to modern digital banking platforms including Airwallex, ANEXT, and Aspire. Digital banks typically offer fully remote onboarding with high approval rates, while traditional banks may require a physical branch visit or video interview for KYC verification.

Terra Advisory Services can guide you through the corporate bank account opening process as part of our Singapore incorporation services. We help you identify the right banking partner based on your business model, ownership structure, and transaction requirements — getting your company operational from day one.

Immigration and Visa Options for Business Owners in Singapore (2026)

Many entrepreneurs choose to relocate to Singapore after incorporating their company — to manage operations directly, to remove the need for a nominee director, or to benefit from Singapore's world-class living environment. Singapore offers several visa pathways for business owners and their teams. For a complete overview, see our Singapore immigration and visa services page, or read our dedicated work visa options for entrepreneurs guide.

Employment Pass (EP) — For Company Directors and Professionals

The Employment Pass is the primary work visa for company directors, executives, and professionals. The minimum qualifying salary as of January 2026 is S$5,600 per month (S$6,200 for financial services roles). All new EP applications are assessed under the COMPASS points-based framework — applicants must score at least 40 points across qualification, salary, diversity, and support factors.

S Pass — For Mid-Skilled Employees

The S Pass is designed for mid-skilled foreign employees earning at least S$3,150 per month (higher for financial services). If you are hiring mid-level staff from overseas for your Singapore company, the S Pass is the standard pathway.

Work Permit — For Foreign Workers in Specific Sectors

The Work Permit applies to semi-skilled foreign workers in sectors such as construction, manufacturing, marine, and services. Eligibility criteria, levy rates, and quota requirements vary by industry and source country.

EntrePass — For Innovative Entrepreneurs

The EntrePass is available to foreign entrepreneurs who wish to start and operate a business in Singapore with innovative characteristics, significant funding, or strong institutional backing. It is the most direct path to becoming a resident director of your own company without meeting the EP salary threshold from day one.

Singapore Permanent Residence (PR)

Singapore Permanent Residence is a long-term option for business owners and professionals who have been working in Singapore on a valid work pass for at least two to three years. PR status allows you to serve as a resident director without renewing a work pass annually.

Dependant's Pass — For Families

EP holders earning a fixed monthly salary of at least S$6,000 can bring their spouse and children to Singapore on Dependant's Passes (DP). Spouses on a DP may also apply for a Letter of Consent (LoC) to work in Singapore.

Common Mistakes When Incorporating in Singapore — And How to Avoid Them

Despite Singapore's streamlined incorporation process, foreign entrepreneurs regularly encounter avoidable pitfalls. Here are the most common mistakes — and what to do instead.

1. Choosing the Wrong Business Structure

Many founders default to a Pte Ltd without evaluating whether a subsidiary or LLP may better serve their business model. Equally, some opt for a branch office not realising the parent company bears unlimited liability. Take time to review entity types carefully before filing — the decision is difficult to reverse once incorporated.

2. Ignoring Post-Incorporation Compliance Deadlines

Many founders focus entirely on getting the company live and then miss their first Annual Return, ECI filing, or AGM deadline. Penalties begin immediately. Engage professional support from day one — read our post-incorporation compliance obligations guide before you incorporate.

3. Not Planning Immigration Alongside Incorporation

Foreign entrepreneurs sometimes incorporate without a clear plan for how they will manage the company from abroad or their pathway to a work pass. If you eventually want to relocate and self-direct the company, your visa strategy must be aligned from the start. Explore your options through our Singapore immigration and visa services.

4. Using an Unverified or Undocumented Nominee Director

Engaging a freelance individual as a nominee director without a Power of Attorney, Deed of Indemnity, and Undated Resignation Letter exposes your company to serious risk. Always use a regulated firm with full documentation. See our Singapore nominee director guide for what to demand before signing.

5. Underestimating Annual Operating Costs

Annual compliance costs — corporate secretary, accounting, tax filing, and nominee director — typically range from S$3,000 to S$8,000 per year for a typical SME. Factor these into your business plan from the outset to avoid cash flow surprises in Year 1.

6. Overlooking the April 2026 Regulatory Changes

The new Corporate and Accounting Laws (Amendment) Bill effective April 2026 introduces stricter AML obligations, mandatory disclosure of nominee arrangements, and significantly higher director accountability. Companies that do not update their governance practices face penalties and potential personal liability for directors.

Frequently Asked Questions: Company Incorporation in Singapore (2026)

How long does it take to incorporate a company in Singapore in 2026?

Company incorporation in Singapore typically takes 1 to 3 business days once all required documents are submitted and KYC is cleared. The ACRA approval itself, once the application is filed through BizFile+ by a Registered Filing Agent, can be granted in as little as one hour. The digital Certificate of Incorporation and UEN are issued upon approval.

Can a foreigner own 100% of a Singapore company?

Yes. Singapore imposes no restrictions on foreign ownership of private limited companies. There is no requirement for a local shareholder or local equity participation. The only statutory requirement is that your company has at least one director who is ordinarily resident in Singapore. See our full guide on foreign ownership of a Singapore company for details.

What is the minimum paid-up capital required to register a company in Singapore?

The legal minimum paid-up capital to incorporate a Singapore company is S$1. However, if you plan to apply for an Employment Pass or open a traditional bank account, a higher paid-up capital — typically S$10,000 or more — is advisable to demonstrate business substance and improve approval outcomes.

Do I need a local director to set up a company in Singapore?

Yes. The Singapore Companies Act requires every company to have at least one director who is ordinarily resident in Singapore. If you are a foreign entrepreneur not yet resident in Singapore, you can engage a professional nominee director service to fulfil this requirement while retaining full control of your company.

How much does it cost to incorporate a company in Singapore in 2026?

Government fees total S$315 (S$15 name reservation + S$300 registration). Professional fees for a full-service incorporation package range from S$500 to S$1,500. If a nominee director is required, total first-year costs typically range from S$3,315 to S$9,515 depending on service levels and compliance requirements.

What is the corporate tax rate in Singapore in 2026?

Singapore's corporate income tax rate is a flat 17%. New qualifying companies enjoy the Start-Up Tax Exemption Scheme for their first three years: 75% exemption on the first S$100,000 and 50% on the next S$100,000 of chargeable income — bringing the effective rate in Year 1 to as low as 4.25% on the first S$100,000 of profit. There is no capital gains tax and no withholding tax on dividends.

What is the difference between a Subsidiary and a Branch Office in Singapore?

A Subsidiary is a separately incorporated Singapore Pte Ltd owned by a foreign parent — it is a distinct legal entity, and the parent's liability is limited to its shareholding. A Branch Office is an extension of the foreign parent and is not a separate legal entity — the parent bears full liability for all branch obligations. Most foreign companies prefer a subsidiary for legal separation, tax benefits, and long-term credibility.

Can I incorporate a Singapore company without being physically present?

Yes. The entire incorporation process can be completed 100% remotely. Documents are signed electronically, and all filings are submitted digitally through ACRA's BizFile+ portal by your Registered Filing Agent. You do not need to visit Singapore to register your company.

What happens if I do not appoint a company secretary within 6 months?

Failure to appoint a company secretary within six months of incorporation is a breach of the Singapore Companies Act and exposes directors to financial penalties. ACRA may issue a composition fine, and the company's compliance standing will be negatively affected. Engage corporate secretarial services as part of your incorporation process to prevent this entirely.

What are the annual compliance requirements for a Singapore company?

Every Singapore company must: file an Annual Return with ACRA within 7 months of the financial year-end; file Estimated Chargeable Income (ECI) with IRAS within 3 months of year-end; submit the Corporate Tax Return by 30 November; hold an AGM within 6 months of year-end; and maintain statutory registers through a qualified company secretary. For the full checklist, see our Singapore corporate compliance 2026 guide.

Ready to Incorporate Your Singapore Company?

Singapore company incorporation in 2026 is faster, more accessible, and more commercially advantageous than ever. With government fees totalling just S$315 and a process that can be completed in as little as one business day, the barriers to entry are minimal — but the rewards of operating from one of Asia's most trusted business hubs are significant.

Terra Advisory Services is an ACRA Registered Filing Agent with deep expertise in Singapore and Malaysia company incorporation, compliance, and immigration. We manage the entire process on your behalf — from name reservation and document preparation through to post-incorporation setup and ongoing compliance — ensuring your company is built on a solid foundation from day one. Get started with our Singapore incorporation services or contact our team for a free consultation.

For deeper market intelligence before you decide, read our State of Singapore Company Incorporation 2026 Report and Forecast — a comprehensive analysis of incorporation trends, growth drivers, and what to expect in the year ahead.

Ready to Get Started?

Speak with our experts at Terra Advisory Services for personalised guidance.

Book a ConsultationOr call us at +65 8961 8383 | Email: info@terraadvisoryservices.com

Important Notice: This guide outlines the standard incorporation procedure for informational purposes. ACRA requirements can change, and individual applications may have unique complexities. To avoid delays or rejection, it is highly recommended to engage professional services. Terra Advisory Services manages the entire process efficiently, ensuring your company is set up correctly from day one.