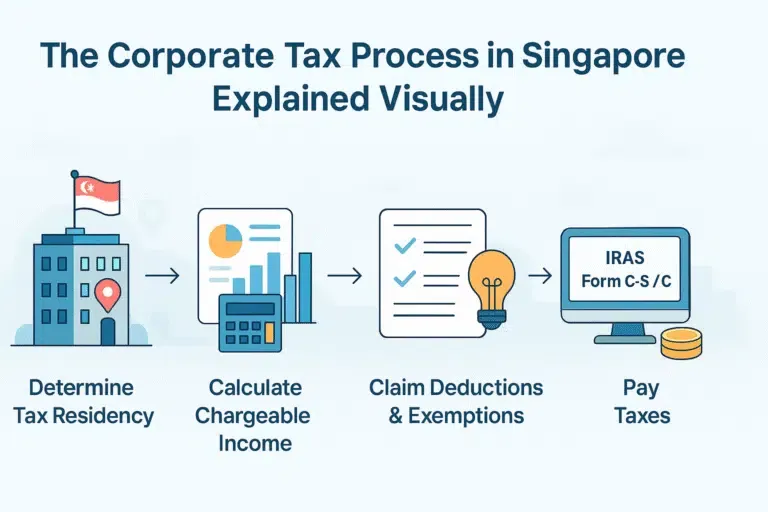

Understanding the corporate tax process is essential for businesses operating in Singapore. This article provides a comprehensive overview of the corporate tax process, simplified into key steps, and is designed to guide business owners through the complexities of tax compliance.

Overview of Corporate Tax in Singapore

Singapore’s corporate tax system is straightforward and designed to promote transparency and compliance. The corporate tax rate is set at 17%, but various exemptions and incentives can lower the effective tax rate for many businesses.

Corporate Tax Process (Singapore)

Where is the company controlled & managed?

If Singapore → treated as tax resident (affects rates & reliefs).

Profit after allowable expenses

Keep accurate books → revenue − deductible costs = chargeable income.

Lower the taxable base

Deduct business expenses; eligible startups may enjoy partial/full exemptions.

Submit Form C‑S / Form C

Deadline: 30 November each Year of Assessment (YA) via IRAS.

Settle assessment

Pay by due date; eligible companies can opt for GIRO instalments.

1) Determining Tax Residency

- Controlled & managed in Singapore → generally tax resident.

- Typical indicators: board meetings and key decisions occur in Singapore.

- Impacts rate, reliefs, treaty benefits.

2) Calculating Chargeable Income

- Start with accounting profit, adjust for tax rules (non‑deductibles, capital allowances).

- Maintain accurate ledgers, invoices, and supporting documents.

3) Deductions & Exemptions

- Deduct wholly and exclusively incurred business expenses.

- Start‑ups: may qualify for SUTE / Partial Tax Exemption to reduce taxable income.

- Carry‑forward of unutilised losses/allowances subject to conditions.

4) Filing Your Return (Form C‑S / C)

- Due by 30 November each YA.

- Form C‑S (simplified) for qualifying small companies; Form C otherwise.

- E‑file via myTax Portal → attach required computations/FS where applicable.

5) Payment

- Pay the Notice of Assessment by the stated due date.

- Eligible companies can pay by GIRO instalments.

- Late payment incurs penalties/interest.

Simple Timeline (Each Year of Assessment)

- Compile accounts → compute chargeable income.

- Confirm residency & reliefs → prepare tax computations.

- E‑file Form C‑S / C by 30 November (YA).

- Receive assessment → pay in full or via GIRO instalments.

Importance of Compliance

Adhering to the corporate tax process is vital for maintaining good standing with regulatory authorities. Non-compliance can lead to penalties and damage a company’s reputation. Engaging a qualified tax advisor can help ensure compliance and optimize tax obligations.

Conclusion

Navigating the corporate tax process in Singapore is essential for business success. By understanding the key steps and maintaining compliance, businesses can focus on growth while minimizing tax liabilities.

Call to Action

If you need assistance with tax compliance or strategic planning, consider consulting a tax professional to optimize your tax position.

To Learn More About the Corporate Tax Process in Singapore

How to set up a company in Singapore:

ACRA – Setting Up a CompanyRecord keeping requirements for companies:

IRAS – Record KeepingSingapore Financial Reporting Standards (SFRS):

ASC – SFRS OverviewFiling your Estimated Chargeable Income (ECI):

IRAS – Filing ECIHow to file your corporate income tax return:

IRAS – Corporate Income Tax FilingCorporate income tax payment process:

IRAS – Paying Corporate Income TaxGeneral information on corporate tax in Singapore:

IRAS – Corporate Income Tax Overview