Mastering Accounting

Accounting is often perceived as a world of complexity—filled with numbers, reports, and technical language. Yet, at its core, accounting is the art and science of telling a business’s financial story. Whether you’re launching your first venture or scaling a thriving company, understanding accounting essentials is your key to confident, strategic decision-making.

Building the Foundation: Organization and Bookkeeping

Every successful business is built on a foundation of sound financial organization.

- Bookkeeping is the daily discipline of recording transactions—your business’s financial diary.

- The General Ledger aggregates these transactions, providing a complete, real-time map of your business’s financial movements.

- Accounts Receivable and Accounts Payable act as your business’s inflow and outflow channels—tracking what you’re owed and what you owe.

Regular, accurate bookkeeping empowers you to identify trends, forecast growth, and avoid costly surprises.

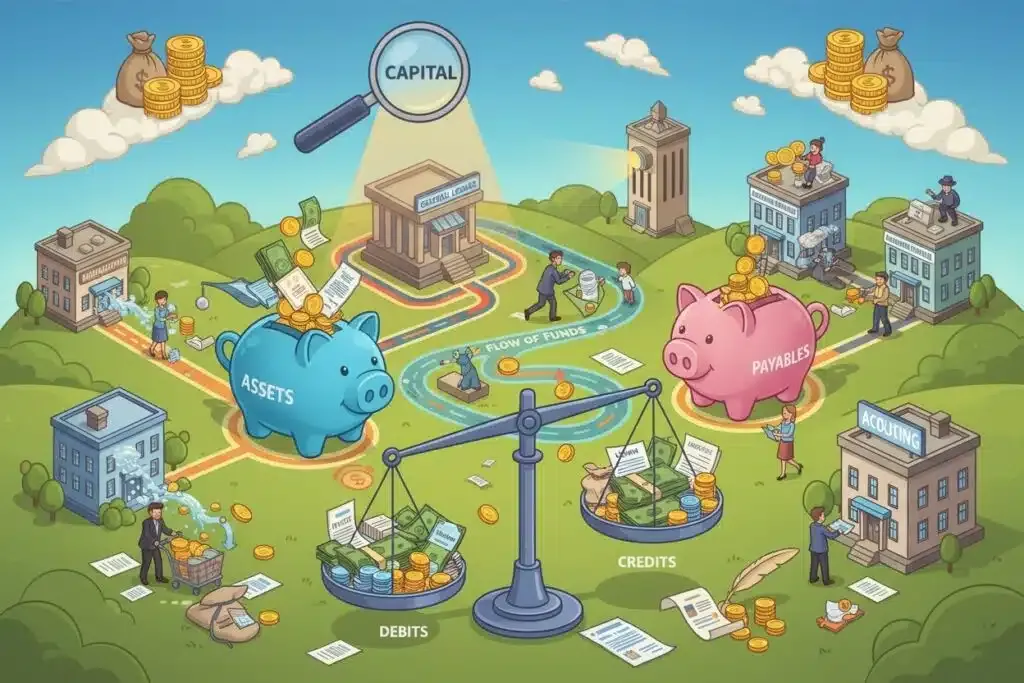

The Dynamics of Assets and Payables

The heart of accounting lies in the careful management of assets and payables:

- Assets are everything valuable your business owns—cash reserves, accounts receivable, inventory, equipment, and intellectual property.

- Payables (commonly referred to as “accounts payable”) represent the amounts your business owes to suppliers, service providers, and creditors. Payables are a key component of your company’s overall financial obligations.

Imagine your business as a well-orchestrated system, where assets fuel opportunity and growth, while payables represent commitments to be honored. Skillful management of both keeps your business resilient and trustworthy.

The Flow of Funds: Revenue, Expenses, and Capital

A business thrives on its ability to generate revenue, manage expenses, and wisely deploy capital.

- Revenue is the lifeblood—money earned from customers and clients.

- Expenses are the necessary investments—salaries, rent, utilities, and more—that keep your business operational.

- Capital represents the financial resources injected by owners, shareholders, or investors to power expansion and innovation.

Tracking the flow of funds helps leaders understand profitability, support growth, and maintain financial agility.

The Art of Balance: Debits, Credits, and the Accounting Equation

If accounting had a golden rule, it would be balance.

- Debits and credits are the dual entries that keep your accounts in equilibrium.

- Every transaction affects at least two accounts, ensuring that the fundamental accounting equation always holds:

Assets = Payables + Equity

This dual-entry system not only prevents errors but also provides transparency and accountability—qualities highly valued by investors, partners, and regulators.

Contracts, Compliance, and Control

Modern accounting extends beyond numbers.

- Contracts formalize business relationships and ensure clarity in transactions.

- Compliance with regulations and tax laws protects your reputation and keeps your operations smooth.

- Auditing expenses and regular financial reviews provide assurance, uncover inefficiencies, and highlight opportunities for optimization.

A disciplined approach to these elements supports long-term stability and trust.

Why Embrace Accounting? The Business Advantage

Accounting is much more than a statutory requirement—it is a strategic advantage. With clear, up-to-date financials, you gain:

- A true understanding of your business performance

- The ability to attract investment and secure loans

- Confidence in decision-making and risk management

- The groundwork for sustainable, profitable growth

Ready to Take Control of Your Finances?

Mastering accounting essentials is the first step toward running a resilient, growth-oriented business. If you’re ready to turn financial complexity into clarity and opportunity, our experienced team at Terra Advisory Service is here to help. We bring expertise, technology, and a passion for your success—so you can focus on what you do best: building your business.

Contact us today and experience accounting made accessible, insightful, and empowering.

Disclaimer: This article is for general educational purposes. For advice tailored to your business, please consult Terra Advisory Service or a qualified accounting professional