A Comprehensive Guide

Singapore company structure options are crucial for entrepreneurs to understand when starting a business. This choice significantly impacts legal obligations, tax liabilities, and operational flexibility. Singapore offers a business-friendly environment, attracting global investors. Therefore, understanding the nuances of each company structure in Singapore is crucial for successful incorporation. This guide explores the primary types of business entities available.

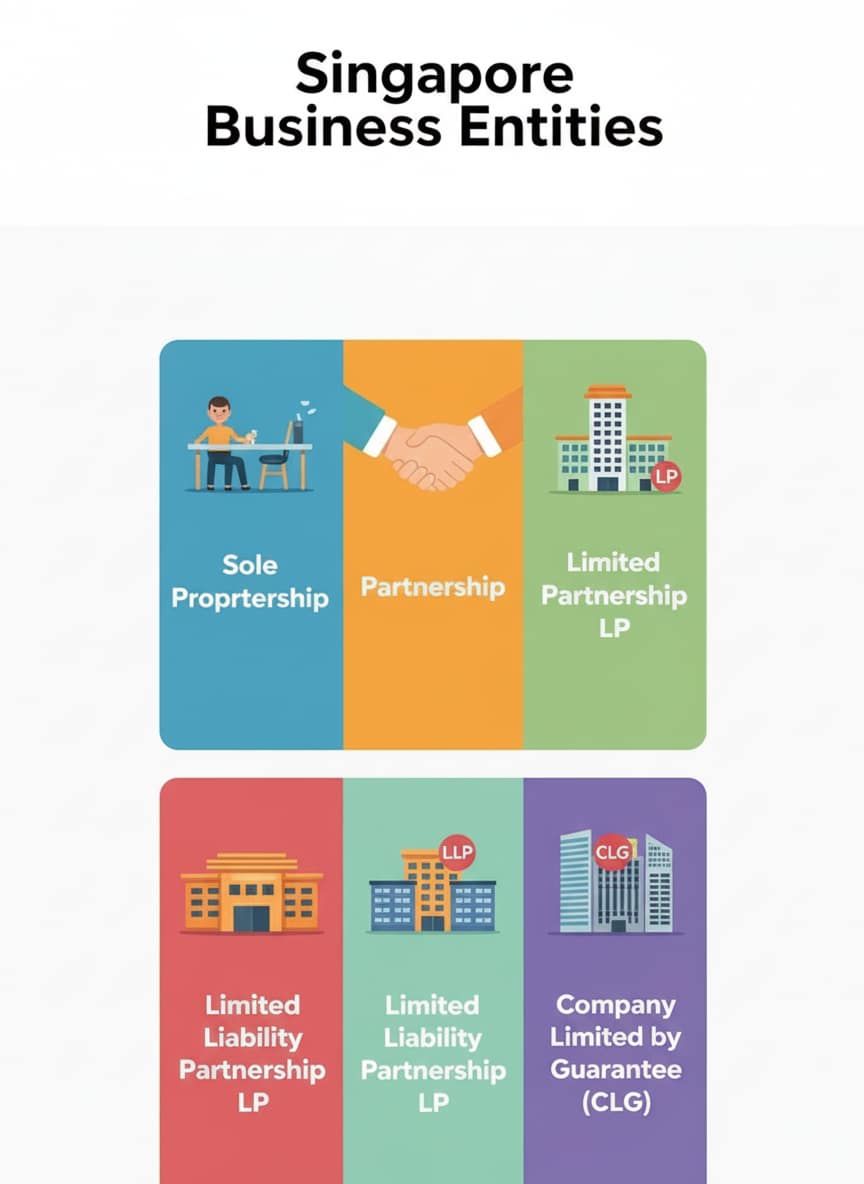

Most Common Business Entities in Singapore

Private Limited Company ( Pte Ltd)

The Private Limited Company is the most common and versatile Singapore company structure. It offers limited liability protection to its shareholders. This means personal assets are separate from business debts. A Pte Ltd company is a separate legal entity. It can own assets, incur debts, and enter contracts in its own name. This structure is ideal for businesses seeking growth and external investment.

Sole Proprietorship

A Sole Proprietorship is the simplest company structure in Singapore. It is owned and operated by one individual. There is no legal distinction between the owner and the business. This means the owner has unlimited personal liability for all business debts. While easy to set up, it carries higher personal risk. This structure suits small businesses or freelancers.

Partnership

Partnerships involve two or more individuals or entities sharing ownership. Partners share profits and losses according to their agreement. General partnerships also entail unlimited liability for all partners. Limited Partnerships (LP) and Limited Liability Partnerships (LLP) offer variations. LLPs provide limited liability to all partners, combining elements of partnerships and companies. This structure balances shared management with varying levels of liability.

Key Considerations for Your Singapore Company Structure

When choosing your Singapore type, evaluate several factors. Consider the number of owners and their liability preferences. Future growth plans and capital requirements are also important. Tax implications vary significantly between structures. Professional advice can help you make an informed decision. Terra Advisory Services provides expert guidance on selecting the optimal structure for your business.

Regulatory Compliance and Governance

Each company structure in Singapore has specific regulatory requirements. Private Limited Companies, for example, must comply with the Companies Act. They need to appoint a company secretary and conduct annual general meetings. Sole proprietorships have fewer compliance burdens. Understanding these obligations is vital for maintaining good standing. Proper governance ensures long-term operational stability.